Clients and Territory

Relationship with our clients and the territory also through technology, is an investment in order to create sustainable value.

We put customers at the centre of our attention and we work to create and develop long-lasting relationships based on trust and mutual satisfaction, offering products and services that meet their needs, in line with their individual risk profile.

from the Banco BPM Group’s Code of Ethics

Key Figures

as at December 2024

2023: € 2.0 billion of green bonds issued

2023: approximately 30% of ESG corporate bonds on the total ESG corporate bonds in the portfolio

2023: over € 8 billion

RELATIONSHIP WITH OUR CLIENTS

Listening to people and businesses and a careful complaint management system represent an essential tool for gaining a deeper understanding of needs, and monitoring and improving our relationship with our clients.

This relationship consists of:

- a commercial model that ensures regional proximity and high levels of service and synergy between physical and digital security;

- financial products that meet various needs, as well as non-financial services and initiatives that reflect the interests of the territory;

- sustainable credit management that combine corporate objectives and risk management, as well as measures to support people and companies in difficulty.

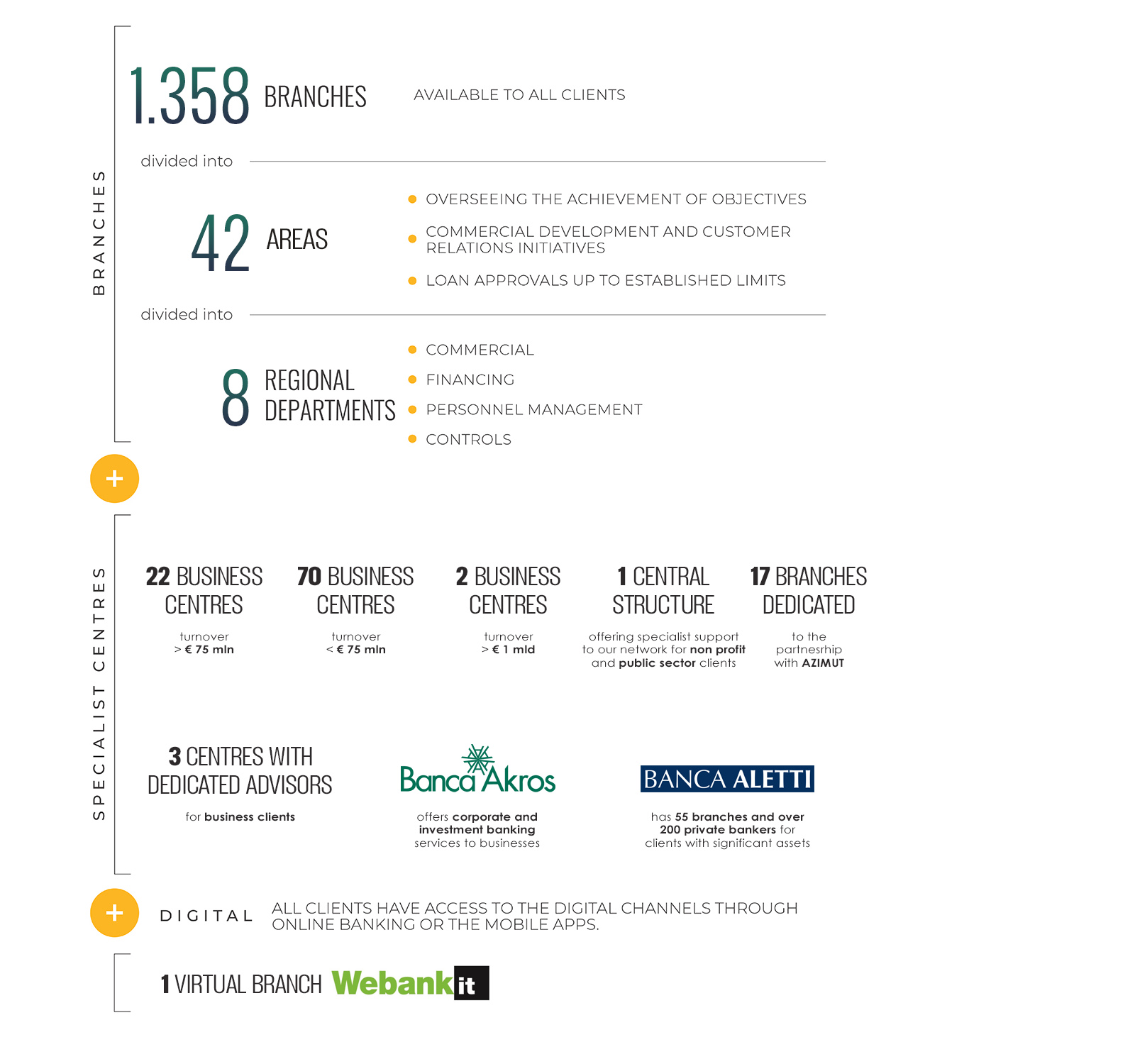

Take a look at our COMMERCIAL MODEL (as at December 2023):

SUPPORT FOR SAVINGS

To provide quality service to all clients, Banca Aletti, which specialises in private banking within the Group, has created a division to support the entire network in order to guarantee the provision of advanced consultancy services tailored to individual needs.

Regarding investment opportunities we offer, we pay particular attention to financial products managed according to ESG (environmental, social and governance) criteria, which are able to direct savings towards activities that generate positive impacts for society. At the end of 2023, the ESG assets under management total € 23.2 billion, 37.5% incidence on the total Asset under management.

BUSINESS DEVELOPMENT

We accompany the growth of our companies also through the support of Banca Akros, the Group’s Corporate and Investment Bank.

In line with the growing importance of offering a range of digital services, in 2023, Banco BPM continued its integration of new cutting-edge channels, with both information and order functions, addressed to companies that work with or intend to work with firms abroad:

- YouWorld is an information platform that enables companies to access comprehensive, constantly updated information on foreign trade and references of potential foreign suppliers or buyers;

- YouLounge is the B2B platform that allows corporate customers to promote their products/services through a virtual display window;

- YouTrade Finance allows goods operations to be managed electronically, simplifying and optimising the bank-customer relationship and ensuring maximum security through guided procedures.

We believe it is essential to accompany the growth of companies also with training courses capable of encouraging the development of technical-managerial skills capable of increasing their competitiveness and the ability to manage risks, seizing market opportunities and overcoming periods of crisis.

INNOVATION

The claim ‘Always close, even online’ sums up our relational approach to meet the new needs of customers and characterises the advertising campaign dedicated to digital transformation through storytelling, which will tell the story of the innovations towards a fully digital bank.