Strategy and ESG Profile

Since the birth of the Group, we have undertaken a path aimed at integrating sustainability not only into the operating model, but also into the corporate culture and identity.

Our aim is to create sustainable value over time, seizing the opportunities presented by a changing environment. Our business model welcomes stakeholder input and integrates environmental, social and governance objectives to translate them into a responsible growth strategy.

Transforming shared challenges in shared value

The stimuli we receive from the context represent important elements for our responsible growth strategy and for our actions which also aim to generate a positive impact on the economy, environment, people and society.

Listening to the context

We start from the relationship with the local area, from listening to stakeholders, from the relationship with the financial market and from the acquisition of international bodies’ indications to identify relevant objectives.

ESG integration into strategy

Our Strategic Plan takes into account material sustainability issues for the Group and integrates ambitious ESG objectives that concern our customers, our people, the environment and the community.

Impact

We distribute a large part of the value we generate, a value that becomes a driver of socioeconomic development for .

Further development of our sustainability strategy

The new Plan continues the growth and innovation path undertaken in recent years and fully integrates sustainability issues into the Group’s strategy, business and activities.

For further information you can consult the Sustainability Report – page 55 (english version soon avalaible).

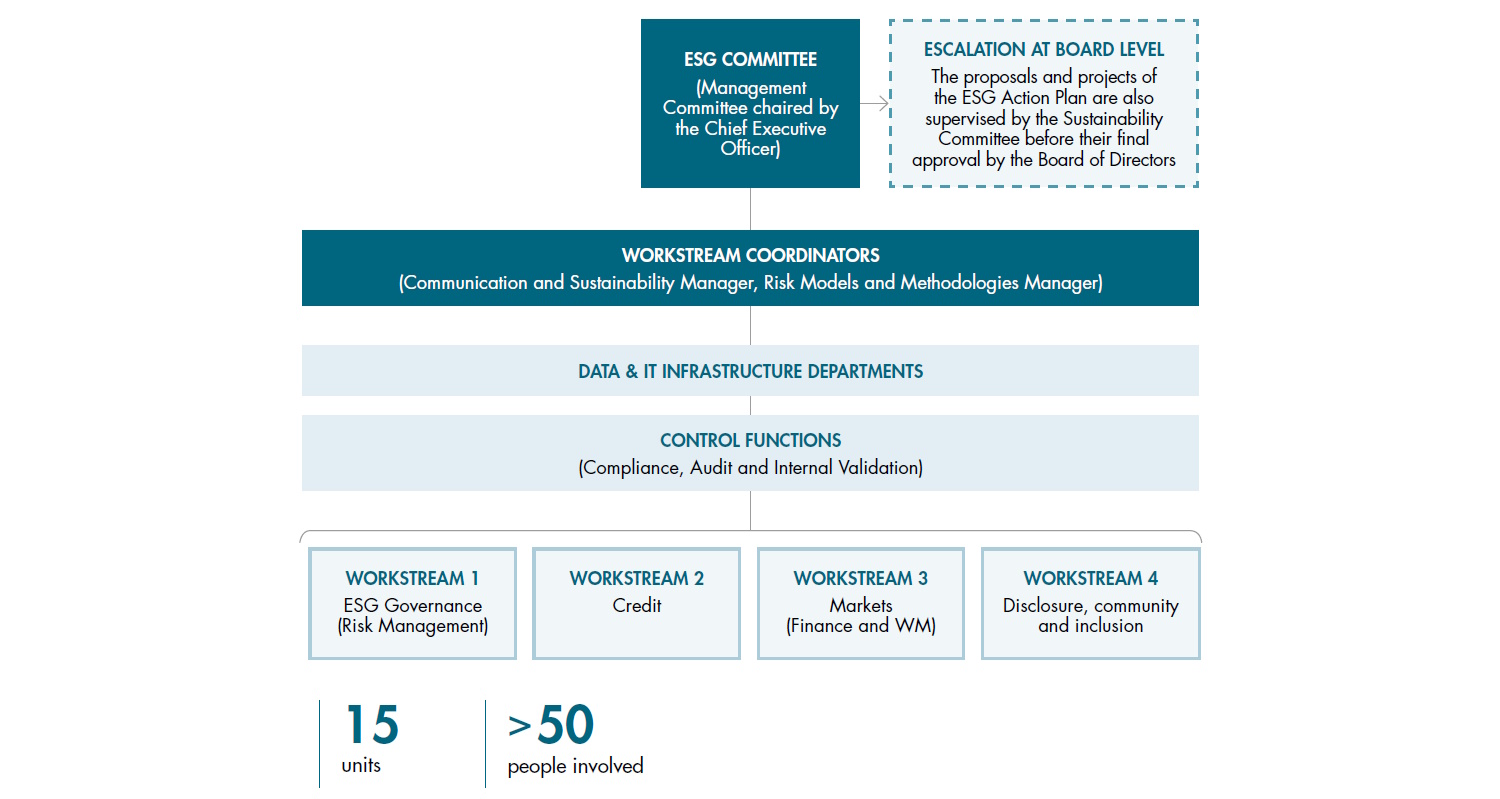

Under the leadership of the ESG Committee and in light of an analysis of the Regulators’ requests, but also of the expectations of the financial market and the best practices of national and international competitors, we have undertaken an important sustainability path. Banco BPM launched a new ESG Action Plan at the end of 2023 in order to further strengthen sustainability governance, rationalizing the previous 7 workstreams (construction sites) into 4 interconnected ESG working groups:

- WS 1 – Risk Management;

- WS 2 – Credit;

- WS 3 – Finance and Wealth Management;

- WS 4 – Disclosure, community and inclusion;

These working groups are supported by the control, data governance and IT functions and supervised by the ESG Committee and the CEO.

ESG Profile

We highlighted our commitment to Sustainability with an important document: our ESG Profile, submitted for the first time at Borsa Italiana’s Sustainability Week 2021, which contains some concrete results achieved in recent years and some goals for the future.