ESG Ratings and Indexes

ESG Ratings

The main public ESG ratings of Banco BPM are shown below. These ratings reflect the assessment of Banco BPM’s results in its sustainability path by the ESG analysis companies. This path includes the commitment to maintain a constant relationship with analysts and investors interested in the ESG issues and to take into account the market interest in business activities and reporting.

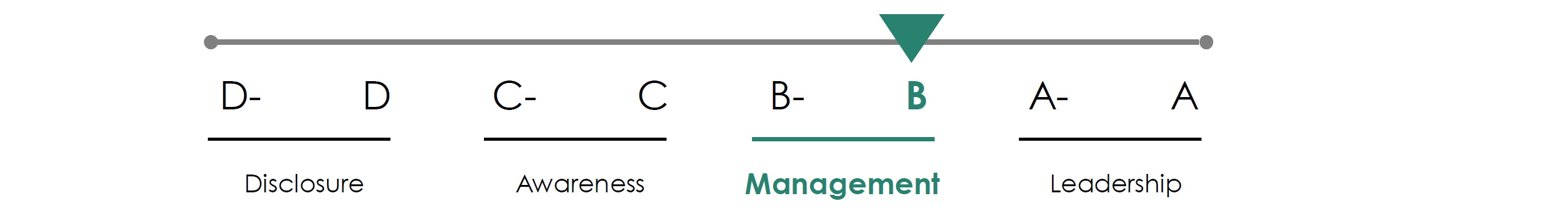

CDP is an international non-profit organization that manages an environmental measurement and reporting system, supporting thousands of companies and other counterparties, in measuring and managing risks and opportunities in the environmental field.

Banco BPM has been assigned a rating of B (updated as at February 2025).

For further information www.cdp.net

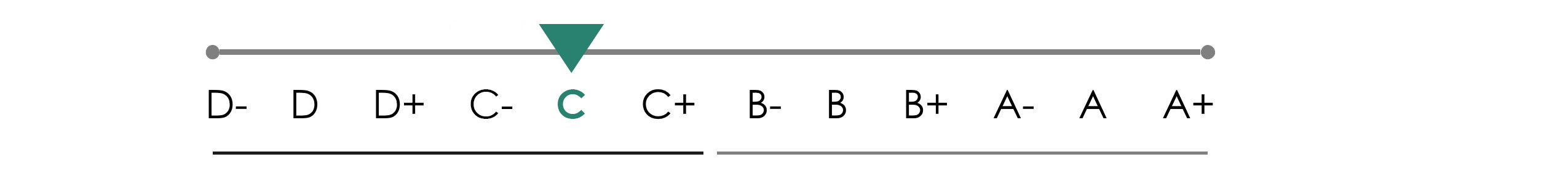

ISS (Institutional Shareholder Services) is a global provider of corporate governance and responsible investment solutions, market information and fund services, events and editorial content to institutional investors and corporations.

Banco BPM obtained a Corporate Rating of C, improving from the previous level of C-.

The Transparency Level also improved, moving from ‘High’ to ‘Very High’.

An improvement was also registered in the Prime Status, which moved from ‘Not Prime’ to ‘Prime’. Concurrently, Banco BPM’s Governance Quality Score was confirmed at the highest level, as already assigned since 2021.

Finally, ISS carried out the Second Party Opinion on Banco BPM’s Green, Social and Sustainability Bond Framework (for more information)

(updated as at January 2025)

For further information www.isscorporatesolutions.com

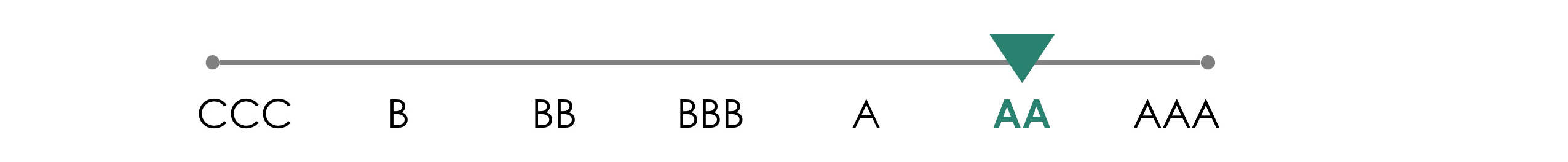

MSCI provides MSCI ESG rating that evaluates companies according to their exposure to industry-specific ESG risks and their ability to manage those risks relative to their peers.

Banco BPM has again improved its score, obtaining a rating of AA, compared to the previous A (updated as at March 2025).

For further information www.msci.com

DISCLAIMER – The use by Banco bpm of any MSCI ESG research LLC or its affiliates (‘MSCI’) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of Banco BPM by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

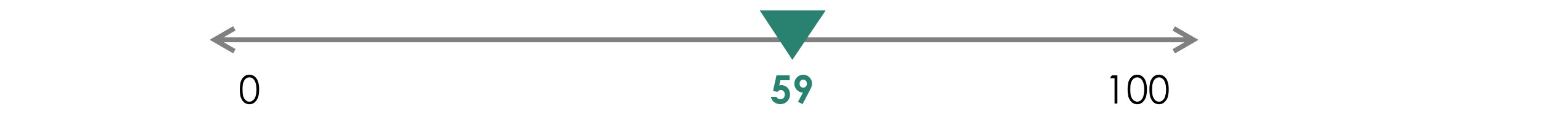

S&P Global is an international provider of benchmarking, research and analytic services in the global capital markets, credit ratings as well as of ESG solutions.

Banco BPM achieved an S&P Global CSA Score of 59, a strong improvement compared to the previous 54 (updated as at October 2025).

For further information www.spglobal.com

Standard Ethics is an independent European rating agency on ESG issues. It provides ratings and gap analysis for companies and countries which intend to compare their positioning with respect to the indications of sustainability and corporate governance promoted by the EU, the OECD and the UN.

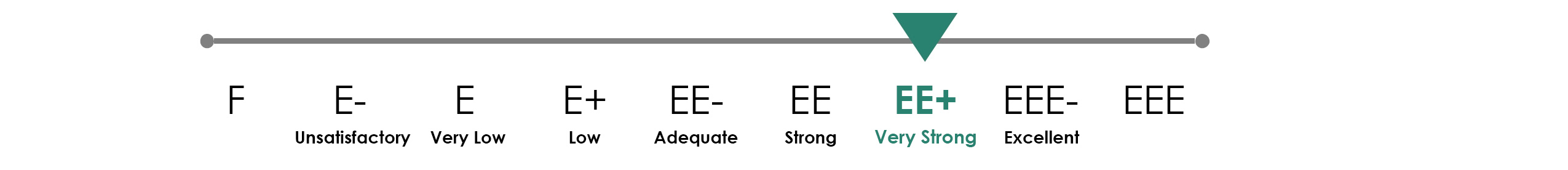

Standard Ethics has confirmed Banco BPM’s Corporate Sustainability Rating at ‘EE+’. Additionally, it has positively revised the estimated time frame for improving the rating level to EEE-, shortening it to 1-2 years.

This assessment takes into account the continuation of our sustainability journey: during 2023, we improved our IT, cybersecurity, and data governance measures, strengthened ESG finance, and achieved carbon neutrality. It is also considered that the Board of Directors is largely independent and that gender equality is ensured within it; sustainability governance and ESG risk management are aligned with best practices (updated as at July 2024).

For further information www.standardethics.eu

Morningstar Sustainalytics is a leading ESG research, ratings and data firm that supports investors around the world with the development and implementation of responsible investment strategies.

Banco BPM obtained an ESG Risk Rating score of 12.6 – a strong improvement compared to the previous 16.0 – confirming its position in the “Low” risk category, which indicates a reduced level of unmanaged risks and a lower likelihood of ESG issues adversely affecting the company’s economic value (score updated in Dicember 2025; last full assessment in August 2025).

For further information www.sustainalytics.com

Disclaimer: Copyright ©2024 Morningstar Sustainalytics. All rights reserved. The information, data, analyses and opinions contained herein: (1) includes the proprietary information of Sustainalytics and/or its content providers; (2) may not be copied or redistributed except as specifically authorized; (3) do not constitute investment advice nor an endorsement of any product, project, investment strategy or consideration of any particular environmental, social or governance related issues as part of any investment strategy; (4) are provided solely for informational purposes; and (5) are not warranted to be complete, accurate or timely. The ESG-related information, methodologies, tool, ratings, data, and opinions contained or reflected herein are not directed to or intended for use or distribution to India-based clients or users and their distribution to Indian resident individuals or entities is not permitted. Neither Morningstar Inc., Sustainalytics, nor their content providers accept any liability for the use of the information, for actions of third parties in respect to the information, nor are responsible for any trading decisions, damages or other losses related to the information or its use. The use of the data is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.

Indici ESG

MIB ESG Index

Banco BPM stock became part of the MIB ESG Index, the first ESG index launched on 18 October 2021 by Euronext and Borsa Italiana and dedicated to Italian blue chips showing ESG best practices.

The composition of the index is based on the liquidity of the securities and on the analysis of ESG criteria by Vigeo Eiris (VE), a Moody’s ESG Solutions company, which identifies, among the 60 most liquid companies on the Italian market, the top 40 on the based on sustainability criteria and corporate social responsibility, in line with the principles of the United Nations Global Compact.

For further information www.borsaitaliana.it

Indici Standard Ethics

Banco BPM is part of the SE Italian Index and the SE Italian Banks Index.

For further information www.standardethics.eu